By Emily Nicolle, Olga Kharif and Stacy-Marie Ishmael

Graphics by Kyle Kim

22 tháng 12, 2022

As 2021 came to a close, crypto enthusiasts were brimming with optimism. After all, it had been a banner year: Nonfungible tokens, or NFTs, had crossed into the mainstream. Casual investors were talking to their friends about the relative merits of Bitcoin versus Ether. Some people even pretended to understand algorithmic stablecoins.

Fast forward a year, and the primary topics of conversation among even the most devout of the crypto faithful were more likely to be about Sam Bankman-Fried, the disgraced crypto co-founder of the fallen FTX empire, or whether they’d ever retrieve the coins trapped on bankrupt exchanges and lending platforms after a series of big digital-asset collapses.

“Crypto winter” is the industry term for the chill that descended on the market in 2022, and contagion was the name of the game. After the collapse of the TerraUSD algorithmic stablecoin, major crypto players fell like dominos: Three Arrows Capital. Voyager Digital, Celsius Network, FTX, BlockFi.

The hits kept coming, but it wasn’t all downside – at least at first. The Super Bowl, one of the largest sporting events in the US, featured splashy, celebrity-filled commercials for crypto companies including Coinbase, Crypto.com and the aforementioned FTX, which was still riding high. There were crypto conferences in the Bahamas and Miami, with sessions about the future of Bitcoin by day and glitzy parties by night. And the industry’s prominence grew in Washington, as lavish political giving and an army of lobbyists signaled its increasing influence there.

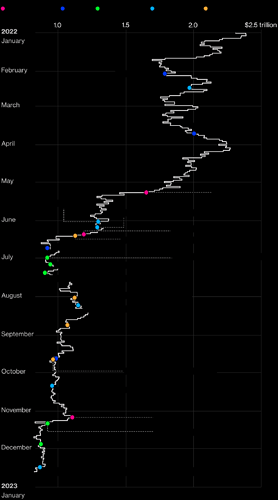

Still, crypto prices kept falling. Bitcoin – the largest token by market value – plunged more than 60%, leading a rout in digital assets that erased some $2 trillion in total market value from the highs reached in November 2021. Bankman-Fried went from being described as a modern John Pierpont Morgan to being arrested and accused of multiple crimes including fraud. And NFT prices fell back to earth.

Crypto’s 2022 Contraction

The total market value of all digital assets

One of the central tenets of crypto, and of the blockchain, is the idea of decentralization: that no one entity is in charge, and no one player could destabilize the rest. What 2022 showed, more than once, is that the digital-asset ecosystem is significantly more interconnected and concentrated than even its biggest participants might have realized.

The Terra ecosystem operated two major tokens: Luna, a cryptocurrency, and TerraUSD (UST), a stablecoin that tried to stay at $1 by maintaining a ratio with the amount of Luna in circulation. In May, UST began a steady decline away from its dollar peg, eventually tanking both coins to zero. Shock waves from the implosion reverberated throughout the market, setting the stage for more blowups in the weeks and months that followed.

Source: Crypto’s 2022 Slump: From Bitcoin Market Drop to Terra, FTX Fall