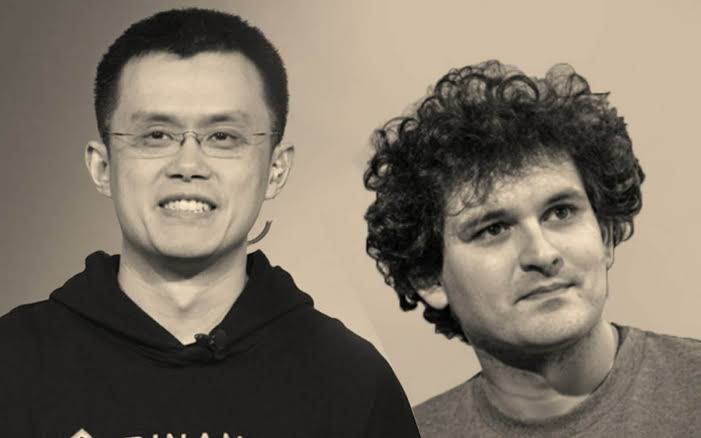

When SBF filed for bankruptcy for FTX, it not only affected small investors but also had repercussions for large organizations. Galois Capital closed down, Sequoia Capital got stuck with $213.5 million, and Multicoin Capital found itself entangled with 10% of its total assets. The actions of SBF and the FTX management team have shaken the confidence of both investors and regulatory authorities in the cryptocurrency market.

Meanwhile, Binance and CZ are facing allegations of violating anti-money laundering laws. The accusations involve Binance employees assisting and illegally onboarding U.S. users onto the international platform, along with transactions related to terrorist groups and money laundering.

In contrast to FTX, the Department of Justice examined all of Binance’s facilities and found no serious errors that could lead to insolvency or another collapse in the cryptocurrency industry. Despite users withdrawing over $1 billion in assets from the platform within 24 hours of CZ facing charges, Binance continues to operate normally. Although Binance had to pay a hefty fine of $4.3 billion, it still maintains its ability to make payments and has enough financial resources to continue operating.

According to Conor, a manager at Coinbase, Binance Corporate owns assets valued at $6.35 billion, including $3.19 billion in stablecoins. These figures do not include cash and unreported electronic wallets from Binance’s Proof of Reserves report.

Join us at bitforum.net as we are The Social Network specialized on cryptocurrency.