Bitcoin fell below $80,000 this week as sweeping U.S. tariff measures introduced by President Donald Trump on April 2, 2025, triggered a global market rout. The announcement of a 10% universal tariff on all imports from 185 countries, alongside sharply increased rates on key trade partners—54% on China, 46% on Vietnam, 32% on Taiwan, and 24% on Japan—sent shockwaves through financial markets.

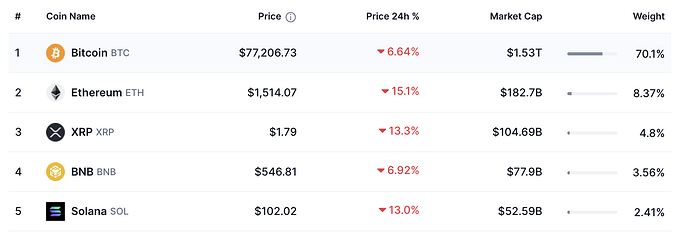

Global stocks lost a staggering $8.2 trillion in value, with the S&P 500 and Nasdaq tumbling over 14% and 19% year-to-date, respectively. Bitcoin led the crypto market downturn, sliding below $80,000 amid broader risk-off sentiment. Ethereum and other altcoins also posted steep double-digit losses.

While the Trump administration framed the tariffs as a necessary step to restore trade fairness and protect domestic industries, investors feared retaliatory actions and a looming recession. JPMorgan CEO Jamie Dimon warned of strained global alliances, while Goldman Sachs raised the probability of a U.S. recession to 45%.

With central banks already cautious and volatility soaring, both traditional and digital markets remain under pressure. For now, Trump’s economic “medicine” has delivered a painful dose to portfolios worldwide.

https://bitforum.net – Crypto forum discussions about all aspects of cryptocurrency bitforum socialfi #InnovationSocialNetwork