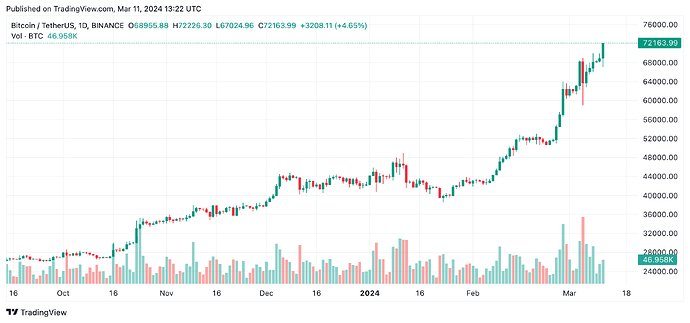

The world’s largest cryptocurrency achieved yet another milestone on March 11th, surpassing $71k in value and boasting a market capitalization exceeding $1.4 trillion.

Over the past 24 hours, Bitcoin saw a 2.6% increase, marking a 10% rise since March 4th. This surge in value came after each Bitcoin surpassed the $71,300 mark, driving its market capitalization beyond $1.4 trillion.

Driving this upward trajectory are both retail and institutional investors, who are increasingly recognizing and embracing the potential of cryptocurrencies as a significant investment avenue.

According to The New York Times, a notable distinction between the current market “wave” and the 2021 boom is the active participation of major financial institutions such as BlackRock and Fidelity. These institutions, often referred to as “whales,” offer Bitcoin ETF funds for immediate trading and collectively hold over 196,000 units.

The involvement of such prominent asset management institutions serves to bridge the gap between Bitcoin and traditional assets, making cryptocurrency investment more accessible even to retail investors who may not be well-versed in its technical intricacies, thanks to the availability of ETF funds.

In addition to Bitcoin’s record-breaking performance, other cryptocurrencies are also experiencing notable highs. Ethereum (ETH) surpassed the $4,000 mark per unit, while Solana (SOL) approached the $150 threshold.

https://bitforum.net – Crypto forum discussions about all aspects of cryptocurrency bitforum socialfi #InnovationSocialNetwork