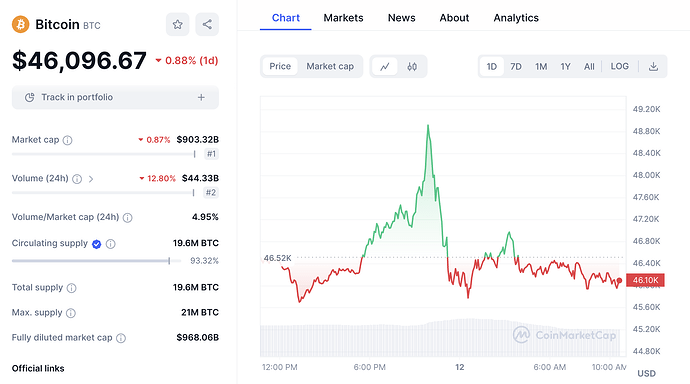

Bitcoin’s price has experienced fluctuations after the approval of the cryptocurrency’s Exchange-Traded Fund (ETF). Bitcoin surpassed $49,000 for the first time in over two years but quickly retreated to the previous range of $46,000 as the market witnessed mixed reactions.

Data: Coinmarketcap

Bitcoin reached $49,000 per unit late yesterday, marking the first time since December 2021 when Bitcoin spot exchange-traded funds (ETFs) began trading in the United States amidst high expectations. The largest cryptocurrency by market capitalization rose from under $46,000 at the beginning of the day to over $47,000 last night, then surged to $49,042 per unit. However, this price level was short-lived as Bitcoin quickly dropped below $46,000.

Data from the London Stock Exchange Group (LSEG) indicates that Bitcoin ETFs recorded trading volumes totaling $4.6 billion as of yesterday afternoon. Among the 11 funds, products from two major asset management giants, BlackRock and Fidelity, dominated the trading volume. This figure is considered relatively strong for a newly established ETF, according to market analysts.

Expert opinions on Bitcoin ETFs are divided, somewhat influencing market sentiment. Many agree that this milestone allows investors to capitalize on the volatile price movements of digital currency without the complications of delving into numerous market concepts such as self-custody, blockchain, and private keys.

https://bitforum.net – Crypto forum discussions about all aspects of cryptocurrency bitforum socialfi #InnovationSocialNetwork