Table of Contents

- What is Celo?

- How does Celo work?

- CELO Team and Partners

- Basic information about the CELO token

Celo is a blockchain that supports dApps, smart contract development, and payments using public keys (email and phone numbers). The Celo ecosystem includes the following products:

Protocol: A Proof-of-Stake blockchain that uses email and phone numbers as public keys. cUSD: A stablecoin pegged to the USD and backed by an investment fund. Celo Wallet: Allows deposit/withdrawal, token swaps between cUSD and CELO using phone number verification.

How does Celo work? The operation mechanism of Celo is based on the following factors:

Lightweight Identity: Celo simplifies the way users share wallet addresses by allowing them to send keys to each other via phone numbers. It eliminates the need for traditional transactions using encoded hexadecimal wallet addresses.

Furthermore, if a user is not registered (unverified phone/email), the protocol will hold the digital assets until verification is completed.

Address-based Encryption: To protect user privacy, the project stores phone numbers on the blockchain by encrypting them into hash functions. T

The process works as follows:

Users send a request attaching their phone number to the public address. When Celo receives the request, users will receive three text messages sent to their phone numbers. After confirming and signing through those messages, and sending them back to the system for verification, users have proven ownership of their phone numbers. Users can also recover or change the address associated with their phone number at any time.

Reputation: Celo utilizes EigenTrust to measure the reputation score of users. EigenTrust is an algorithm that records the trust score of an account (phone number). The reputation score is calculated based on the level of trust that other users have in this user.

Stabilizing Value: Celo owns multiple stablecoins pegged to various fiats/assets such as USD, Euro, Greek baskets, oil prices, etc. Each stablecoin is maintained by adjusting the supply according to user demand.

Additionally, the project also holds collateral assets to ensure the price stability of stablecoins during market fluctuations.

Stabilizing mechanism ensuring exchange rate Stabilizing mechanism ensuring exchange rate

Celo’s value stabilization model: Celo has a supply of cGLD to stabilize its value. cGLD will be partially activated upon the mainnet launch, and the remaining portion will be mined over time. The cGLD supply is used as follows:

50% is reserved for stablecoin collateral. The remaining 50% is used for buy-back and burn (similar to Bitcoin and Ether) and then transferred to reserves. Stabilizing the cUSD value with cGLD follows the process below:

When cUSD is higher than the normal level → Demand exceeds supply → The project sells cGLD to mine additional cUSD through the CP-DOTO DEX. Stabilizing the cUSD value with cGLD

When the cUSD price is lower than the peg → Demand is lower than supply → The project purchases cUSD from the market to swap with cGLD in the reserve through the CP-DOTO DEX. The purchased cUSD will then be burned.

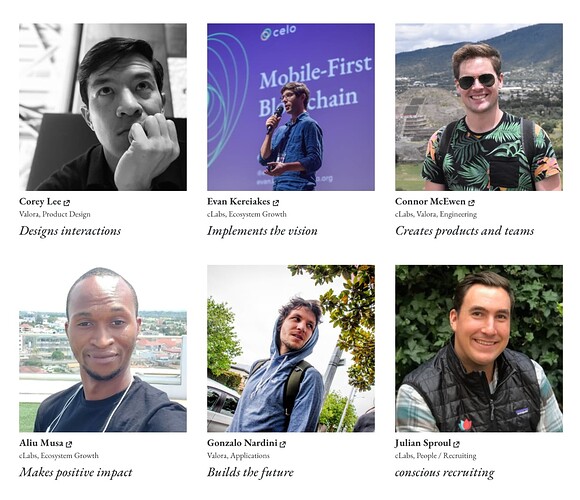

CELO Team and Partners:

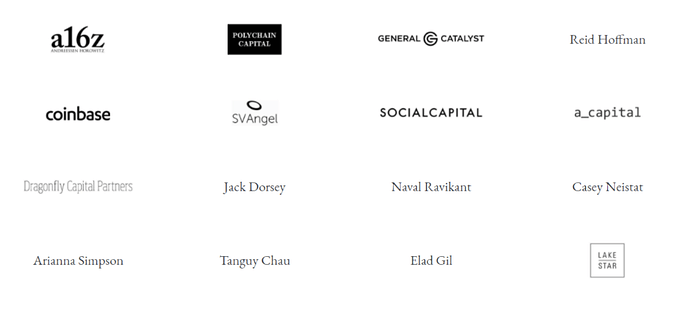

Project Partners:

Basic information about the CELO token:

Technical specifications:

Ticker: CELO

Token Type: Utility, Governance

Total Supply: 1,000,000,000 CELO

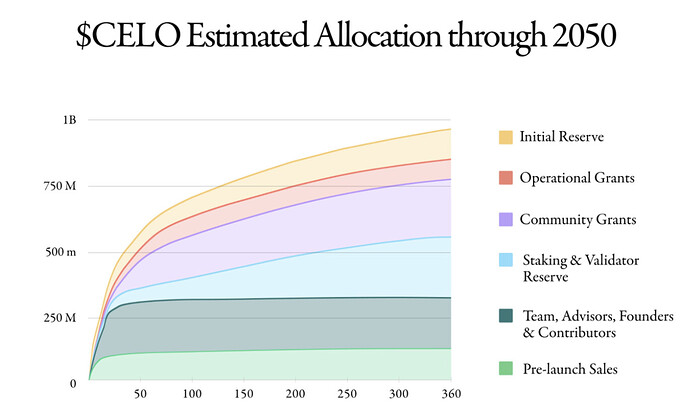

Token Allocation:

The token allocation for the project is as follows:

12.5%: Allocated to investors in the pre-launch sale.

17.3%: Allocated to developers and contributors.

30%: Allocated as rewards for staking and validators.

19.5%: Allocated as a community fund.

7.5%: Allocated as a fund for ecosystem activities.

12%: Allocated as a reserve fund for stablecoin.

In conclusion, CELO is an open-source blockchain project that supports dApps, smart contract development, and payments using public key infrastructure based on email and phone numbers. It operates through a lightweight identity system, address-based encryption, reputation scoring, and stabilizing value mechanisms. The CELO token serves as a utility and governance token within the project, with a total supply of 1,000,000,000 CELO. The token allocation includes distributions for investors, developers, staking rewards, community funds, ecosystem activities, and stablecoin reserves. CELO aims to provide a secure and inclusive platform for decentralized applications and financial services.

https://bitforum.net – Crypto forum discussions about all aspects of cryptocurrency #Bitforum #SocialFi #InnovationSocialNetwork