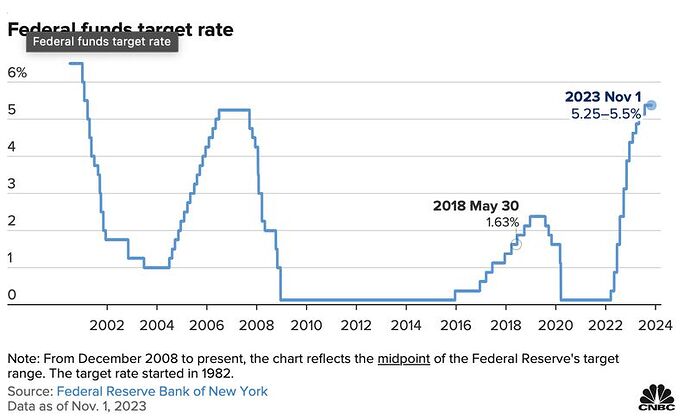

The U.S. Federal Reserve (Fed) has decided to keep the benchmark interest rate unchanged in its two-day policy meeting on December 13, aligning with market expectations. The current benchmark interest rate in the U.S. remains stable at the highest level in 22 years, fluctuating between 5.25% and 5.5%. Fed also held the interest rate steady in both September and November.

Since March 2022, the Fed has adjusted interest rates 11 times to control inflation. Currently, inflation in the U.S. has significantly decreased compared to the peak reached last summer, marking a positive development.

However, the Fed’s battle against inflation is not yet over. Fed officials predict that the inflation rate for the next year will decrease and occur more slowly than anticipated, as stated in yesterday’s announcement.

Some economists believe that this final stretch is the most challenging phase. Fed Chairman Jerome Powell and other officials do not rule out the possibility of further interest rate hikes.

Investors are betting that the Fed may reduce interest rates as early as March. The latest estimates from the Fed also indicate that officials anticipate a more substantial interest rate reduction next year than initially expected.

This move will support the frozen U.S. housing market, given the high mortgage interest rates and weak demand.

https://bitforum.net – Crypto forum discussions about all aspects of cryptocurrency bitforum socialfi #InnovationSocialNetwork