What is Governance Token and it function?

In order to maintain decentralization while making decisions, Web3 developers have explored various innovative approaches in countless DeFi projects. These developers strive to efficiently scale their operations while considering the perspectives of all network participants. While each protocol has its unique way of handling blockchain governance, governance tokens are often seen as the most effective solution. Despite their imperfections, governance tokens have played a significant role in how dApps reach agreements, and anyone involved in Web3 should understand their impact on the future of DeFi.

To understand governance tokens, it is necessary to have a basic understanding of blockchain governance. This refers to the activities and protocols involved in reaching agreements and implementing changes in a crypto project. While permissioned blockchains can have a hierarchical governance structure, open-source projects typically aim to maintain decentralization. Rather than dictating a project’s future direction, Web3 developers will often submit improvement proposals online and subject them to community voting, with the community’s response determining the project’s direction.

Blockchain governance can be divided into two categories: on-chain and off-chain governance. On-chain governance involves activities that take place directly on a project’s blockchain, such as voting on proposals using governance tokens. In contrast, off-chain governance refers to discussions that occur outside of the blockchain, such as polls on social media, in-person meetings, or online debates.

A governance token is a type of cryptocurrency that provides its holders with voting rights in the on-chain governance of a crypto project. Typically, each token equates to one vote in the decision-making process for upcoming proposals, though other methodologies are possible. Holders of governance tokens can use them to accept or reject changes to a dApp or blockchain during scheduled voting periods, and some dApps allow token holders to propose initiatives and put them up for a vote. While governance tokens are not exclusive to DeFi, they are the most common in this sector, with many of the top decentralized exchanges and crypto lending sites using them to give their community members a voice.

Use case of Governance Tokens

Governance tokens have many use cases in DeFi, including deciding on a crypto project’s treasury allocation, upgrading a dApp’s UI/UX, adjusting interest rates on crypto lending sites, and tweaking rewards for liquidity providers. In addition to voting, governance tokens can also be used for native staking on a dApp to earn interest rewards, adding to a liquidity pool on a DEX, and trading in the cryptocurrency market.

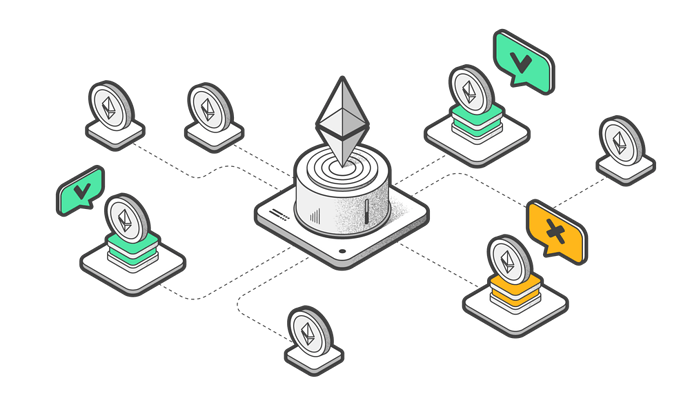

To release governance tokens, a DeFi project launches them on a smart contract blockchain such as Ethereum, and each dApp has a unique token issuance policy that is typically outlined in a whitepaper. DeFi protocols often set aside governance tokens to use as rewards for community members who lock their crypto in a dApp’s liquidity pools. Voting with governance tokens typically involves connecting a crypto wallet to the governance portal on a dApp, selecting the number of tokens to vote with, and submitting the vote. DAOs are often used in the blockchain governance of DeFi projects, allowing stakeholders to submit proposals and tally votes while relying on smart contracts to avoid human manipulation.

Governance tokens and utility tokens are two terms that are sometimes used interchangeably in the world of cryptocurrencies. While they do share some features, there is one key difference between the two, and that is voting power.

A governance token is a type of utility token that grants the holder the right to vote on proposals related to the blockchain or dApp that they are involved with. In contrast, a utility token may have many use cases on the blockchain, including voting, but it does not necessarily grant the holder any special voting privileges.

One example of a utility token that is not a governance token is the Basic Attention Token (BAT) used on the Brave browser. While BAT does serve as an incentive for advertisers and users, it does not give holders any voting power over the Brave browser’s future direction.

Despite this technical difference, governance tokens offer many advantages to Web3 users. They help preserve decentralization by giving every stakeholder a vote in upgrades to a dApp, which spreads the power of decision-making throughout the community. Governance tokens are also highly efficient, providing a formalized way to resolve issues by voting instead of informal off-chain methods like forum debates or conventions. They can prevent schisms in the community by giving network participants a way to air their grievances, which can help reduce the odds that disgruntled developers will turn away to create a competing “forked” blockchain.

Furthermore, governance tokens enhance transparency by recording votes on the blockchain and entrusting them to coded smart contracts that prevent manipulation during the voting process. Finally, governance tokens promote community collaboration by opening up the voting process to token holders, which fosters a sense of ownership and can lead to novel proposals and positive community sentiment.

Remained issues/challenges

However, there are also some challenges associated with governance tokens that need to be considered. Selfish or malicious actors can sometimes act against the community’s best interests, and whales and validator pools can dominate voting if they hold a disproportionate amount of governance tokens. Additionally, anonymity can remove accountability, making it difficult to hold anyone responsible for poor governance decisions. There is also a risk of smart contract code failure that voters must rely on Web3 developers’ skills when voting in DAOs.

Despite these concerns, there are many examples of governance tokens in the world of cryptocurrencies. Some of the most prominent ones live on the Ethereum blockchain, such as Uniswap’s UNI, Aave’s AAVE, Maker’s MKR, and Compound’s COMP. These governance tokens allow holders to vote on adjustments to the protocol’s issuance, collateral requirements, interest rates, and other governance-related decisions.

Conclusion

In conclusion, while not every crypto project uses governance tokens, they have become a standard feature on the world’s biggest DeFi sites. As developers gain more experience with governance protocols, they may discover better ways to ensure everyone’s voice is heard, and these cryptocurrencies will likely serve a vital function in many high-profile DAOs.

https://bitforum.net – Crypto forum discussions about all aspects of cryptocurrency #Bitforum #SocialFi #InnovationSocialNetwork