Bitcoin and Ether lead the way with nearly $90 million and almost $75 million, respectively.

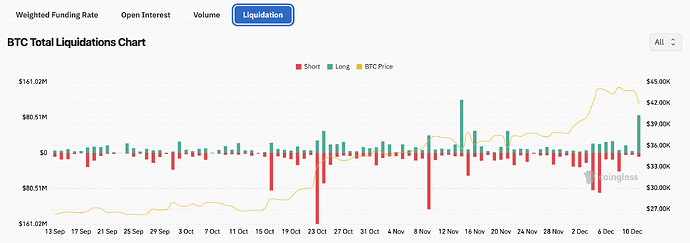

Data from the Coinglass tracking platform indicates that the cryptocurrency market has seen over $335 million in assets liquidated in the past 12 hours. Bitcoin and Ether lead the way with nearly $90 million and almost $75 million, respectively.

Investors are believed to be taking profits following a hot growth phase in the cryptocurrency market. According to experts, mass profit-taking actions like these are reasonable after a strong growth period in the recent short term.

From the beginning of the month until now, the Bitcoin price has consistently set new highs, reaching the highest point in over a year and a half. On average, this currency has increased by over 20% in the past month and surged by 60% compared to the beginning of October.

At one point, Bitcoin reached nearly $45,000. The market has been largely optimistic due to mild comments from U.S. regulatory authorities regarding cryptocurrencies and the hope that a Bitcoin exchange-traded fund (ETF) may be established soon.

This week, investors will focus on U.S. inflation data and the final policy meeting of the Federal Reserve in 2023. If the interest rate cut scenario unfolds as expected, the cryptocurrency market is likely to soon regain upward momentum.

Join us at bitforum.net as we are The Social Network specialized on cryptocurrency.