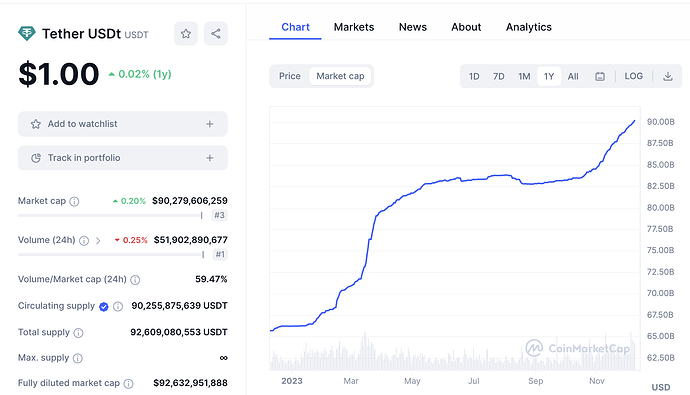

As per the CoinMarketCap report, USDT has witnessed a remarkable surge, accumulating around $24 billion from the inception of 2023 to December 2023. This surge propelled its market capitalization from $65.7 billion in January 2023 to $90.25 billion by December 8, 2023.

Within the year 2023, BlackRock has expressed concerns about the risks associated with USDT (Tether) and USDC (USD Coin) stablecoins, could cause negative impact to the Bitcoin and Crypto market.

On the bright side, the substantial increase in Tether’s issuance underscores the growing demand for stablecoins within the cryptocurrency market. With its popularity among traders and investors, USDT serves as a reliable store of value and an efficient method for transferring funds across various platforms and exchanges.

Tether’s expanding activity signifies its dedication to addressing the evolving needs of the digital asset ecosystem