One of the protocols favored by many users in DeFi is SushiSwap. So what is SushiSwap? How do you use SushiSwap?

Alongside Uniswap - a DeFi protocol well-known among crypto users, there are now many other platforms offering numerous benefits and features, among which SushiSwap stands out.

What is SushiSwap?

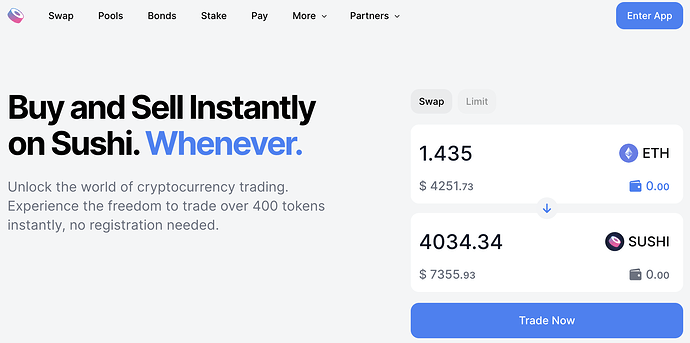

SushiSwap is a decentralized exchange (DEX) utilizing the Automated Market Maker (AMM) mechanism. SushiSwap enables users to trade cryptocurrencies and process transactions through smart contracts.

Introduced in 2020, SushiSwap is built on the Ethereum blockchain and is considered a fork of Uniswap - one of the most popular DeFi protocols today.

SushiSwap quickly gained significant attention from the crypto community upon launching the SUSHI governance token. Right from its official debut, SushiSwap captured the spotlight, even “siphoning liquidity” from Uniswap.

SushiSwap is a decentralized exchange (DEX) using the AMM mechanism.

Additionally, SushiSwap offers key products to provide users with a convenient and effective trading experience, including:

- SushiSwap Exchange: This is a decentralized exchange protocol built on the Ethereum blockchain, which doesn’t use order books. Instead, the platform employs the AMM model.

- Liquidity Pools: Liquidity providers receive fees for their services.

Advantages and Disadvantages of SushiSwap:

Advantages:

SushiSwap introducing its own token is one of the improvements compared to other decentralized exchanges. SushiSwap provides an internal token as a “reward” for those contributing to its ecosystem.

Community management and incentivizing better liquidity are also advantages of this exchange. Specifically, SushiSwap also uses a 0.3% transaction fee as a reward similar to UniSwap, but the difference is that instead of using the entire 0.3% to reward LPs (Liquidity Providers), Sushi divides it into 0.25% for LPs and the remaining 0.05% for SUSHI token holders.

Disadvantages:

The SushiSwap interface might be a bit overwhelming for beginners.

High gas fees (most Ethereum-based AMMs have high gas fees).

https://bitforum.net – Crypto forum discussions about all aspects of cryptocurrency bitforum socialfi #InnovationSocialNetwork