The US Consumer Price Index (CPI) did not rise in May, indicating that inflationary pressures have eased for the world’s largest economy. Consequently, the likelihood of the Federal Reserve (Fed) cutting interest rates in September has increased.

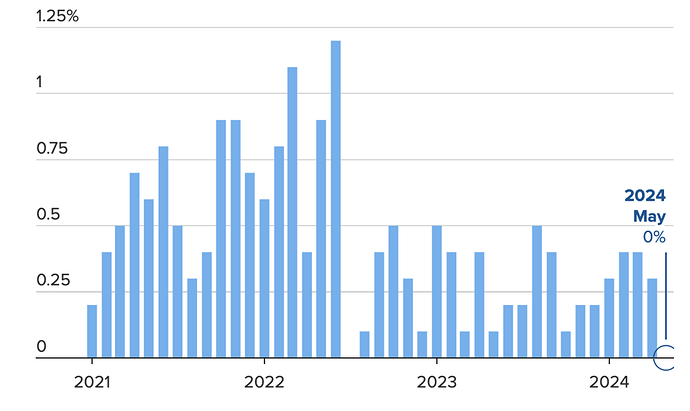

A report from the Bureau of Labor Statistics, released on June 12, showed that the CPI, a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services, remained flat in May compared to April but increased by 3.3% year-over-year. Previously, a Dow Jones survey of experts had predicted a 0.1% monthly increase and a 3.4% annual increase for May.

The core CPI, which excludes volatile food and energy prices, rose by 0.2% from April and 3.4% year-over-year, both figures falling 0.1 percentage points below the forecasts of 0.3% and 3.5%, respectively.

Although both the overall and core CPIs were lower than expected, inflation in the housing sector increased by 0.4% for the month and 5.4% year-over-year, exceeding expectations. Housing costs are a particularly stubborn factor that the Fed contends with in its fight against inflation, constituting a significant portion of the CPI basket.

The overall moderation in price increases was primarily due to a 2% drop in energy prices and a mere 0.1% rise in food prices. Notably, gas prices fell by 3.6%. Another category with modest price increases was auto insurance, which rose by 0.1% for the month but remained up more than 20% year-over-year.

“There is finally some positive news, as both headline and core inflation came in below expectations. While inflationary pressures at gas stations have eased, housing prices continue to climb and are the main driver of inflation. Until housing costs begin to fall, a significant drop in overall inflation is unlikely,” noted Robert Frick, an economist at Navy Federal Credit Union.

This CPI report comes at a critical juncture for the US economy, as Fed officials consider their next monetary policy moves, heavily influenced by inflation trends.

The report was published ahead of the conclusion of a two-day Fed policy meeting. Market expectations are that the Fed will keep the federal funds rate steady at 5.25-5.5% in this meeting, while focusing on signals regarding future monetary policy directions.

Following the CPI release, futures markets increased bets on the Fed starting to cut rates in September. However, the timing of the Fed’s rate cuts has been volatile recently, with Fed officials emphasizing the need for more than 1-2 months of declining inflation data before easing policy.

https://bitforum.net – Crypto forum discussions about all aspects of cryptocurrency bitforum socialfi #InnovationSocialNetwork