dYdX stands out as one of the prominent decentralized exchange (DEX) platforms in the world of cryptocurrencies. However, its initial construction on the Ethereum platform resulted in several limitations in terms of scalability. In response to these lingering constraints, the dYdX Chain was introduced to address such issues. So, what exactly is the dYdX Chain, and what sets this blockchain apart?

Introduction to dYdX:

dYdX is a decentralized exchange (DEX) offering a range of derivative products such as spot trading, leveraged trading, and futures contracts. Initially developed on the Ethereum platform, dYdX leverages zk-Starks technology to reduce transaction costs and enhance speed.

Employing an orderbook model for its trading platform, dYdX provides users with a better and more familiar experience akin to traditional centralized exchanges (CEX).

However, building on Ethereum also introduced challenges, including transaction fees and speed, particularly during network congestion.

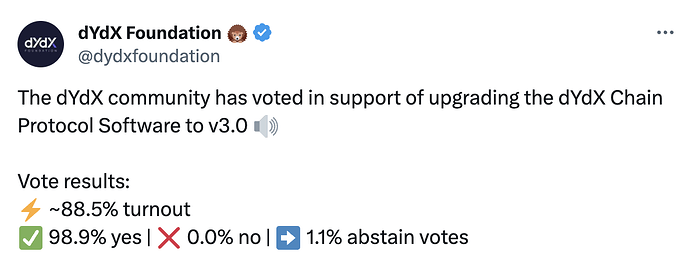

In September 2023, dYdX announced the development of its dedicated blockchain, named dYdX Chain, utilizing the Cosmos SDK to overcome the limitations of its existing platform.

How does DYDX operate?

DYDX exchange is currently a formidable player in the cryptocurrency market. With approximately 70,000 traders, it generates a profit of around $11 billion, and its Total Value Locked (TVL) continues to increase over time. DYDX stands at the top of the list of platforms providing derivative products based on TVL.

Key products and features of DYDX trading include:

- Providing Margin & Spot trading for investors with leverage up to 5x, supporting three currency pairs: ETH-DAI, ETH-USDC, and DAI-USDC.

- Offering Perpetual trading with leverage up to 10x, supporting three pairs: BTC-USD, ETH-USD, LINK-USD.

- Providing lending with waiting periods and no minimum loan requirement, supporting ETH, DAI, and USDC tokens.

- Borrowing with a minimum collateral ratio of 125%, supporting DAI, ETH, and USDC tokens, with collateral ratios above 115% to avoid liquidation.

In addition to these products, DYDX also supports portfolio management for participants, allowing investors to control their trades and receive volume-based fee discounts. DYDX also provides publicly available data and useful price predictions for participants.

https://bitforum.net – Crypto forum discussions about all aspects of cryptocurrency bitforum socialfi #InnovationSocialNetwork