As per Coindesk, Sam Bankman-Fried, in a widely-known incident, expressed his intention to purchase all available Solana tokens for $3 each. During his testimony in his criminal trial, he disclosed that he had actually initiated his purchase of SOL at a much earlier stage, acquiring them for as little as 20 cents per token.

Regarding the financing of these investments, Bankman-Fried, when questioned by his attorney, stated, “I believed the funds came from Alameda’s operating profits,” alongside contributions from external lenders.

SOL has gained the moniker “Sam Coin” due to its strong association with Bankman-Fried. His entities made significant investments in projects and assets built on the Solana platform, promoting its brand extensively prior to FTX’s collapse in November of the previous year.

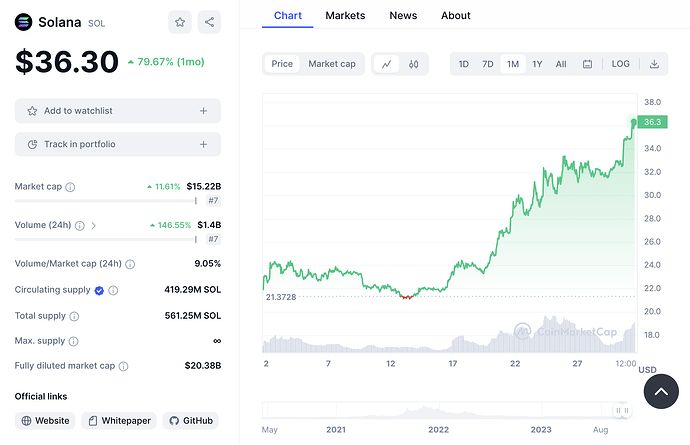

Considering the $Sol price, there is a possibility of a substantial sell-off to liquidate FTX assets and settle FTX debts.

The potential for a significant sell-off of $Sol can be speculated due to the need for liquidity to address the financial obligations stemming from FTX’s collapse. In situations where a company faces substantial debt or financial challenges, liquidating assets, including $Sol holdings, might become a necessary step to generate immediate capital for debt repayment and to stabilize the financial situation.